Your all-in-one policy claims portal Predictive AI Generative AI Agentic AI analytics cloud

core insurance software solution

Policy • Billing • Claims • Portal • Cloud • AI • Analytics

Designed for organizations that understand artificial belongs inside the core, not bolted onto it.

Experience the difference with Spear

Our core software solutions with built-in Accessible AI are designed to make insurance management easy and efficient. From policy administration to claims management to billing to portal solutions, and everything in between.

Full P&C Insurance Suite

The SpearSuite™ is a comprehensive property and casualty core insurance software solution designed for your business.

Partnership & Trust

We value every customer relationship and view our role as more than a vendor - we are a long-term partner and trusted technology advisor.

Customer Managed Solution

SpearSuite™ is cloud-native, built on the low-code Microsoft Power Platform and entirely customer managed. You license and operate the technology directly - giving you full ownership, control, and long-term cost advantages.

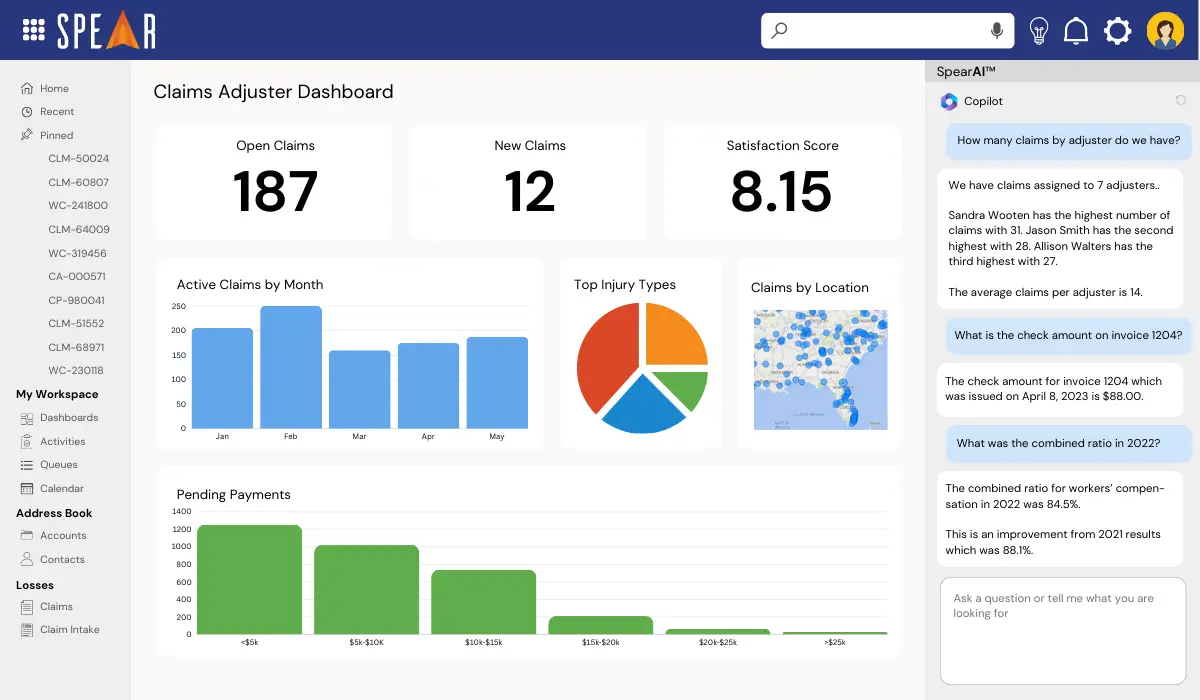

AI & Analytics

Turn raw data into actionable insights. Dive deep into analytics and empower your decision-making. Leverage built-in AI to improve every facet of operations.

Intelligent Automation

Enhance customer experiences, cut costs, improve efficiency, and empower the business to automate tasks with intelligence.

Stellar Support & Services

Spear delivers powerful core software solutions, backed by a white-glove service commitment we deliver on every day.

The Next Wave of P&C Insurance Solutions

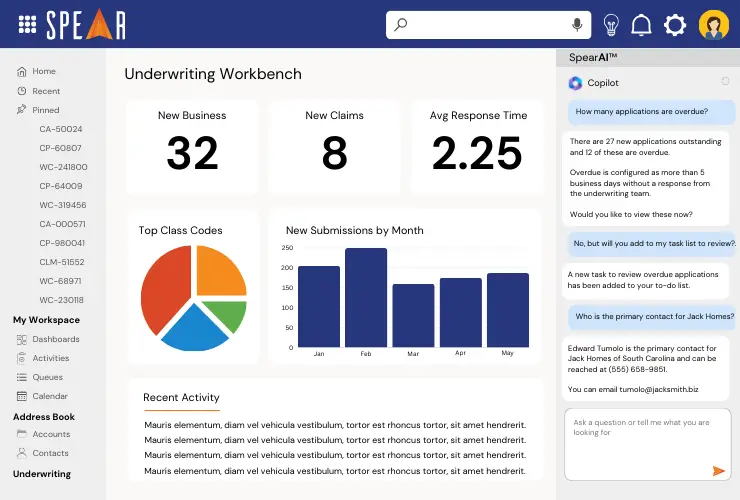

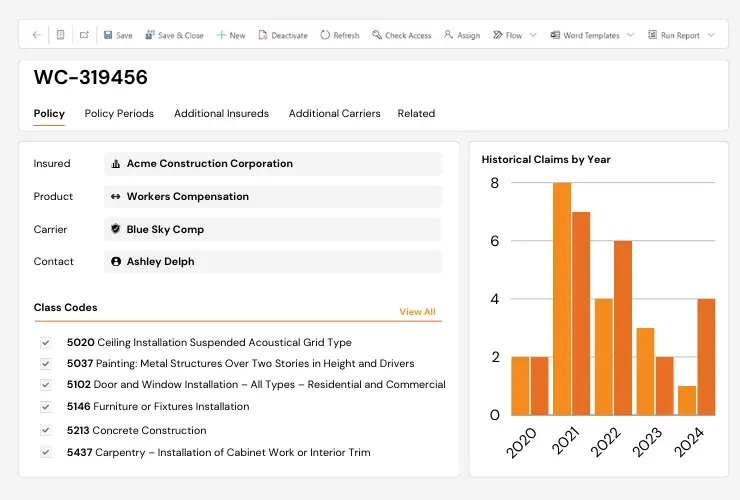

Revolutionize policy administration & billing

Experience the benefits of modern technology to simplify everything from underwriting to billing while tapping into the benefits of integrated AI and deep data insights.

-

Improve underwriting

-

Automate routine tasks

-

Better understand your data

The Next Wave of P&C Insurance Solutions

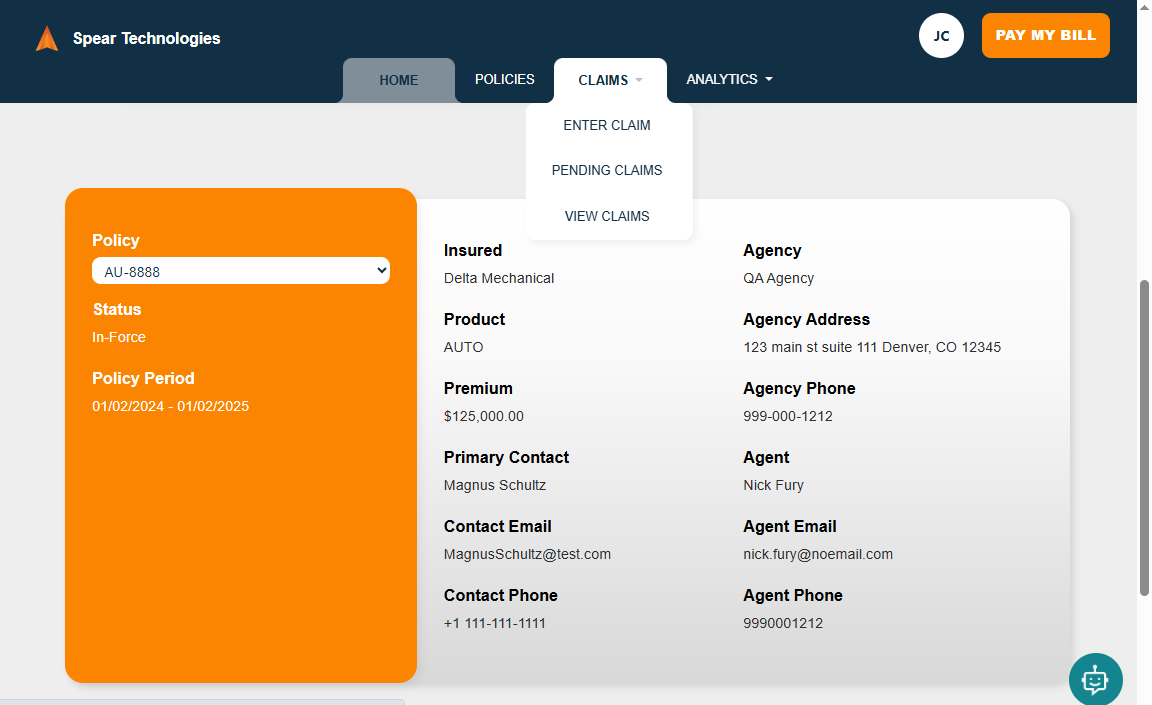

Be easy to do business with

From new business submissions to providing stellar service to your insureds, SpearPortal™ makes it possible.

-

Increase agent loyalty

-

Expand communication channels

-

Enable self-service

The Next Wave of P&C Insurance Solutions

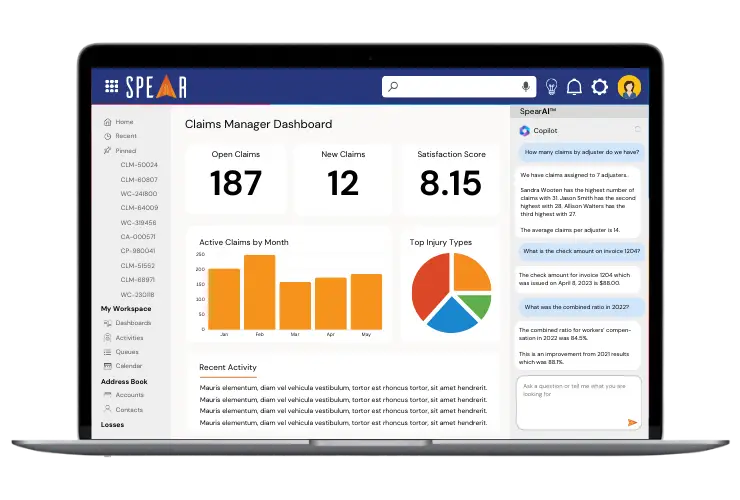

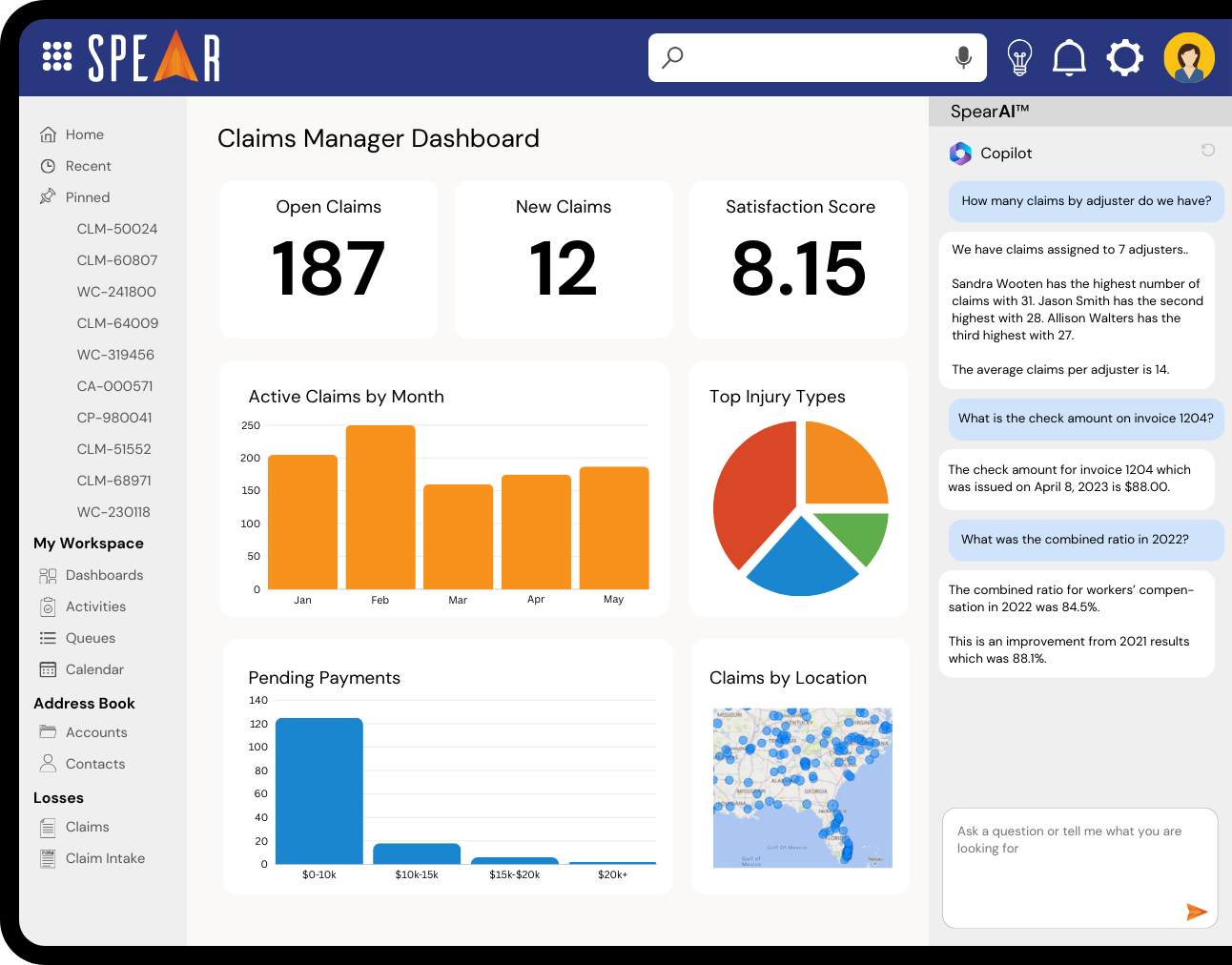

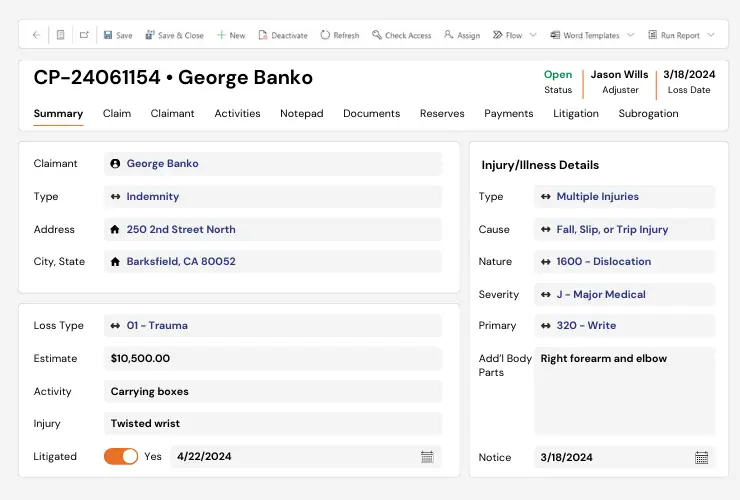

Improve outcomes with better insurance software solution software

Take back control and manage your claims better with predictive analytics, intelligent automation, and flexible configuration

-

Seamless FNOL reporting

-

Leverage AI recommendations

-

Focus on human aspect of work

Tap into third-party connectors

Integrate easily with your preferred third-party service providers. Our growing ecosystem includes 1000's of plug & play integrations out of the box.

Driving innovation in insurance

At Spear we are pushing the limits to deliver innovative core technology solutions to level the playing field across our industry.

Breaking the Silos: How Orchestrated AI Connects Claims, Policy, and Billing

Insurance organizations rarely struggle because of a lack of technology. More often, they struggle because technology operates in silos. Claims, policy, and billing systems typically evolve independently as each department optimizes its own workflows, metrics, and tools. As a result, insurers create fragmented operations that limit visibility, slow decision making, and increase operating effort. However, that model no longer scales. As […]

Underwriting in an Orchestrated AI Environment: From Risk Assessment to Real-Time Decisions

Underwriting has always been the foundation of insurance performance. Pricing accuracy, portfolio quality, and long term profitability depend on how effectively underwriters assess risk and make decisions. Yet for many insurers, underwriting technology continues to lag behind claims. Increasingly, claims teams are leveraging AI-driven workflows and automation, while underwriting teams are still relying on static rules, fragmented data, and manual decision making. However, that dynamic is rapidly changing. […]

Beyond Automation: What Agentic AI Means for Claims Adjusters and Supervisors

The End Goal is Better Claims Outcomes, Not Just automation for its Own Sake. For years, claims automation has been framed as a cost-reduction exercise: automate tasks, reduce headcount, move faster. That framing has created understandable resistance among adjusters and supervisors who worry that AI is designed to replace judgment rather than support it. Agentic AI changes […]

Your success is our success

Discover how businesses like yours transformed with our software. Real stories of growth, innovation, and success.

Book a Demo

Fill out and submit the form below and we'll follow-up with you to book a demonstration of our innovative insurance software solutions!

Ensuring Compliance with SpearClaims™

"SpearClaims™ has been a game-changer for us. One of the highlights our auditor noted was the convenience of having all the necessary information easily accessible and the seamless navigation within the application. It made their job much easier, eliminating the need to search extensively for information - something they often encounter with other, more cumbersome core software solutions."

~ Tammy Cramer, Pitman Family Farms

A customized technology implementation analysis ultimately resulted in operational efficiencies and improved customer service, enabling this insurer to serve its dealer members with the most economic workers compensation available in the State of Virginia.

Virginia Auto Dealers Assoc.

Virginia

To remain the premier provider of long-term, stable solutions for workers’ compensation insurance in Utah means thinking smart when it comes to risk management and loss prevention growth initiatives; so the firm sought the best possible use of digital technology.

Utah Business Insurance Co.

Utah

A small workers’ comp carrier successfully manages large risks thanks to automation, superior loss prevention and claims handling, and personalized attention to customer service.

Synergy Comp

Pennsylvania

Spear Technologies

Being the best at what we do

Unlock the potential of your business with Spear's full suite of P&C insurance core solutions.

Ready to supercharge your business?

With more than 15 years delivering innovative P&C insurance solutions, you won't be left behind when you partner with Spear!

Request Pricing

Fill out and submit the form below and we'll follow-up with you.

Book a Demo

Fill out and submit the form below and we'll follow-up with you to book a demonstration of our innovative insurance software solutions!